We research all the brands mentioned and may receive a fee from our partners. Research and financial concerns may impact how brands are presented. Not every brand is included. Learn more.

Birch Gold IRA reviews show why this precious metals company has earned trust from retirement investors since 2003. Gold prices shot up to $3,120 per ounce in March 2025, and you might wonder if a gold IRA fits your retirement plans. Based in Burbank, California, Birch Gold Group has handled over $3.3 billion in transactions and served more than 36,000 customers throughout all 50 states.

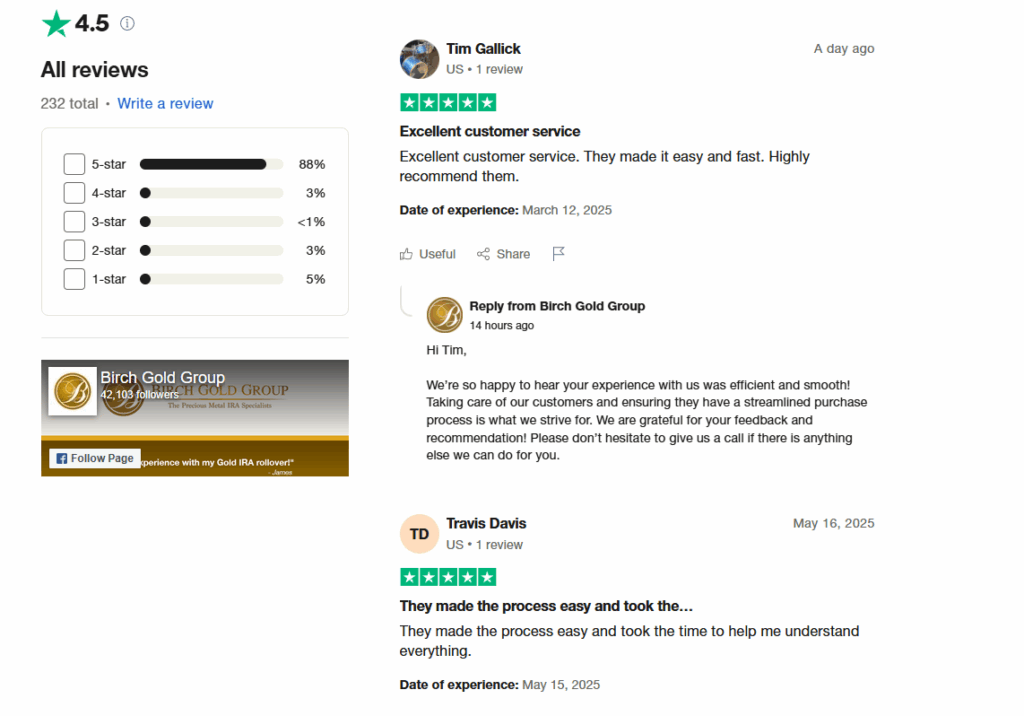

The company’s reputation tells a compelling story. Their Trustpilot reviews average 4.2 out of 5 stars, and they’ve maintained an A+ Better Business Bureau rating since 2011. On top of that, investors love Birch Gold’s straightforward fees – a one-time $50 setup charge and $200 yearly costs whatever your account size. The company’s legitimacy shines through their AAA rating from the Business Consumer Alliance.

Ben Shapiro and Jordan B. Peterson’s endorsements add more credibility to their name. The $10,000 minimum investment makes them available to serious retirement planners who want to add gold, silver, platinum, or palladium to their portfolio. This complete Birch Gold IRA review will help you decide if they’re the right fit to guide your precious metals investment, especially if economic uncertainty has you looking beyond traditional retirement options.

Are Your Retirement Savings Over $50,000?

Looking to protect your investments from inflation? Diversify your portfolio with a Gold IRA. Secure your assets by investing in gold coins, bars, and bullion. Starting is simple – click on your state now and take the first step toward a more secure financial future!

What Is Birch Gold Group and How Does It Work?

Birch Gold Group, a 20-year old precious metals dealer, has become one of the nation’s prominent dealers of physical precious metals since 2003. The Burbank, California-based company helps Americans protect their retirement savings through alternative investments for nearly two decades.

Company Background and Mission

Birch Gold Group’s mission helps customers understand precious metals investing better. The company’s team brings years of experience in finance, including former wealth managers, financial advisors, and commodity brokers who worked at major institutions like Citigroup, Dun & Bradstreet, and IBM.

Their approach differs from competitors by prioritizing education before sales. Knowledge, dedication to customized care, and trust are the company’s three core values. Specialists take time to understand your specific goals and concerns before suggesting any investment options.

The company’s impressive credentials include an A+ rating from the Better Business Bureau, an AAA rating from the Business Consumer Alliance, and numerous 5-star ratings on review websites. These ratings demonstrate their steadfast dedication to ethical business practices and customer satisfaction.

Overview of Precious Metals IRA Services

Birch Gold Group helps you set up and manage a Precious Metals IRA – a self-directed retirement account holding physical gold, silver, platinum, and palladium instead of paper assets. This tax-advantaged investment vehicle lets you broaden retirement savings with tangible assets that historically protected against inflation and economic uncertainty.

Setting up a Precious Metals IRA through Birch Gold involves these key steps:

- Original consultation with a dedicated Precious Metals Specialist

- Account setup with a trusted custodian (Equity Trust Company or STRATA Trust Company)

- Funding through rollover, transfer, or direct contribution

- Selection of IRS-approved precious metals

- Secure storage at an approved depository (Delaware Depository or Brink’s Global Services)

The company supports various account conversions: Traditional IRA to Gold IRA rollovers, 401(k) to Gold IRA rollovers, and transfers from other retirement accounts like 403(b)s, 457(b) plans, TSP accounts, SEP IRAs, and SIMPLE IRAs. Your assigned specialist guides you through fees, taxes, timing, and required minimum distributions consistently.

Birch Gold’s flat-rate annual fee structure benefits investors with larger accounts compared to percentage-based fees. Their transparent pricing includes a one-time $50 setup fee, $180 total annual maintenance fees, and a $30 wire transfer fee.

Who Birch Gold Group Is Best For

Birch Gold Group serves investors of all types. New precious metals buyers benefit from patient guidance and educational approach. Their specialists explain complex concepts clearly without pressure tactics.

The company excels at helping retirement savers broaden their portfolios beyond traditional stocks and bonds. They work best if you have at least $10,000 in existing retirement accounts. This minimum investment creates a meaningful position in precious metals while ensuring personalized service.

Long-term investors focused on wealth preservation find value in Birch Gold. Their Precious Metals IRAs strategically complement conventional retirement vehicles, especially if your investment horizon extends beyond five years and you want inflation protection.

Birch Gold Group stands out for conservative investors seeking protection against economic instability. Their customer-first approach, clear pricing, and detailed educational resources help you make informed decisions with expert guidance rather than navigating the precious metals market alone.

Gold IRA Setup Process: Step-by-Step Guide

Setting up a Gold IRA with Birch Gold Group takes just five steps. The company makes precious metals investing simple and straightforward. Their team has spent years perfecting this process to give you a seamless setup.

1. Original Consultation and Free Kit

Your experience starts with a no-obligation chat with a dedicated Precious Metals Specialist who learns about your retirement goals and answers your questions. You can get Birch Gold’s detailed information kit free of charge. This 24-page guide helps you learn about how gold and silver protect against inflation and perform well when traditional markets don’t.

The free kit has everything about custodians, rollovers, IRA-eligible metals that meet IRS requirements, and how to open your precious metals IRA. Birch Gold believes in helping clients make informed decisions rather than rushing into purchases.

2. IRA Custodian and Account Setup

After your consultation, you’ll pick an IRA custodian – a financial institution that manages your Gold IRA. The IRS requires a custodian to handle all retirement plans to keep their tax-deferred status.

Birch Gold partners with specialized custodians like Equity Trust Company and GoldStar Trust Company. These companies are prominent names in the precious metals industry. These IRS-approved custodians take care of:

- Processing transactions and paperwork

- Managing relationships with storage facilities

- Handling IRS reporting and asset distributions

You’ll pay a one-time fee between $30 and $50 to set up your account, plus annual management fees around $100.

Make the Right Choice

Check Out My Top Recommendations

3. Rollover or Transfer of Funds

Your next step is funding your Gold IRA after setting up the custodian account. You have several options:

You can move money from existing retirement accounts through a direct transfer between custodians or an indirect rollover. With indirect rollovers, you’ll get the distribution and must deposit it in your new Gold IRA within 60 days to avoid taxes and penalties.

The process works with Traditional IRAs, Roth IRAs, SEP IRAs, SIMPLE IRAs, 401(k)s, 403(b)s, 457 plans, TSPs, and certain pension plans. Most transfers take one to three weeks, depending on your current custodian’s processing time.

4. Selecting IRS-Approved Metals

Your Precious Metals Specialist will help you choose IRS-approved precious metals once your account has funds. The IRS has specific purity requirements:

- Gold must be 99.5% pure (American Eagle coins are an exception at 91.67% pure)

- Silver needs 99.9% purity

- Platinum and palladium must be 99.95% pure

Your specialist explains the benefits of each metal and product type before you make your final selection.

5. Finalizing Storage and Documentation

The last step secures your metals at an IRS-approved facility. Birch Gold Group works with several top depositories:

- Delaware Depository offers $1 billion in asset coverage and $100,000 transit insurance per package

- Brink’s Global Services has secure locations in Los Angeles, New York City, and Salt Lake City

- Texas Precious Metals Depository provides fully segregated, sealed, annually audited storage

These facilities use advanced security to protect your assets. You maintain legal ownership of your metals even while they’re in storage. Storage and insurance costs run about $100 per year.

Your dedicated Precious Metals Specialist stays available throughout this process to answer questions and guide you. They make sure you have the support you need to set up your Gold IRA with confidence.

Birch Gold IRA Fees and Pricing Transparency

Birch Gold IRA reviews consistently praise the company’s transparent fee structure. The company stands out from its competitors by clearly outlining all precious metals IRA costs upfront. Their straightforward approach lets you know exactly what you’ll pay without any surprises later.

One-Time Setup and Wire Fees

Your Birch Gold IRA comes with two one-time fees. The account setup fee is $50, which takes care of all administrative paperwork and compliance requirements for your new self-directed IRA.

A wire transfer fee of $30 applies to move your funds into your new IRA. This covers the secure electronic transfer of your investment capital. The good news is Birch Gold Group often waives these fees for bigger accounts.

Annual Storage and Maintenance Costs

Two recurring fees come with your Birch Gold IRA each year. You’ll pay a $100 storage and insurance fee to keep your precious metals safe in IRS-approved depositories. This ensures your gold, silver, platinum, or palladium stays protected in top-tier facilities with full insurance coverage.

The yearly management fee runs about $125 to handle account administration, paperwork, and compliance. This includes your account statements, tax reporting, and year-round customer support. Most Birch Gold customers pay around $225 total per year.

Birch Gold’s flat-rate structure gives them an edge. You pay the same annual fees whatever your account size – this works great for investors with larger portfolios. Your relative costs drop as your account grows, which could boost your investment returns.

Fee Waivers for Larger Accounts

Birch Gold Group has a great offer for accounts over $50,000 – they cover your first year’s fees. This means you won’t pay the annual storage, insurance, or management fees for 12 months, saving about $225.

This waiver lets more of your money work for you right from the start. The savings add up quickly for retirement savers making big transfers. The company openly promotes this benefit, showing their commitment to cost transparency.

How Birch Gold Compares to Competitors

Money.com points out that Birch Gold Group leads the pack in fee transparency, noting they’re “one of the few gold IRA companies we came across that includes transparent fees on its site”. Many competitors either hide their fees or make them hard to figure out.

The $225 yearly flat fee looks even better compared to competitors who charge percentage-based fees, especially for accounts over $100,000. Some competitors might have lower annual fees but often make up for it with higher precious metals markups or hidden charges.

The $10,000 minimum investment puts Birch Gold in the middle range for accessibility. This amount helps you build a solid precious metals position while getting personalized attention from their specialists.

The value goes beyond basic account management. You get a dedicated Precious Metals Specialist, educational resources, and ongoing support. Their A+ BBB rating and positive client reviews focusing on service quality show why many choose Birch Gold, even though their fees might be slightly higher than some alternatives.

Storage and Security: Where Your Gold Is Held

Security is the life-blood of any precious metals IRA. Your physical gold and silver’s storage needs careful thought. Birch Gold Group collaborates with premium depositories to keep your valuable assets protected throughout their time in your retirement account.

Segregated vs Non-Segregated Storage

Setting up a precious metals IRA through Birch Gold Group requires choosing between two main storage options. Segregated storage keeps your gold and silver in a dedicated vault or area, separate from other customers’ assets. This option guarantees that your specific metals stay exclusively yours and are identifiable as your personal property.

Non-segregated (or commingled) storage places your precious metals with other investors’ holdings in a shared vault. The depository guarantees you’ll receive equivalent items of similar type, weight, and purity upon withdrawal, though they might not be your original pieces. This method costs less than segregated storage since multiple customers share the operational costs.

Both options maintain the same security standards and full insurance coverage. Your preference for direct asset identification versus cost savings will guide your choice. Advanced tracking and inventory systems make sure your holdings are recorded accurately.

Approved Vault Locations and Insurance

Birch Gold teams up with several prominent depositories in the United States. Each facility provides exceptional security:

- Delaware Depository – This facility has $1 billion in full insurance coverage plus $100,000 transit insurance per package. Their locations in Wilmington, Delaware and Boulder City, Nevada use cutting-edge security systems with round-the-clock surveillance. Delaware Depository keeps all precious metals off its balance sheets, which means your assets legally remain yours.

- Brink’s Global Services – Famous for their armored vehicles, Brink’s has secure facilities in Los Angeles, New York City, and Salt Lake City. They are the world’s largest non-bank, non-government precious metals holder. Their security-focused approach includes strict transport protocols by land, sea, and air.

- Texas Precious Metals Depository – This Shiner, Texas facility offers fully segregated, sealed storage. They conduct annual audits and provide 100% insurance coverage of your assets.

- International Depository Services – Their class III gold vaults come with continuous off-site monitoring. They have branches in Texas and Delaware.

These facilities feature fortified structures, multiple security checkpoints, extensive surveillance, and trained staff who handle precious metals. Your investment stays protected against theft, damage, and other risks.

Can You Visit Your Stored Metals?

Birch Gold’s clients can visit their metals at Delaware Depository, International Depository Services, or Texas Precious Metals Depository. The process starts with a call to your custodian to schedule a visit. The depository staff will then reach out to arrange your appointment and ask for ID documents.

Your visit will be professional yet highly secure. Metal detectors, surveillance cameras, and security checkpoints are standard protocol. Staff members escort visitors at all times. They bring your metals from the vault to a conference room where you can verify their presence and condition.

The depositories prohibit taking photos of employees or facilities. Nothing can leave the premises without authorization. This whole process shows their steadfast dedication to security and customer service. You’ll have peace of mind knowing your retirement assets are safe and secure.

Customer Experience and Birch Gold Group Reviews

Customer satisfaction metrics show why many investors pick Birch Gold for their precious metals IRAs. The company’s 20+ year history has built an impressive collection of ratings on independent review platforms. These ratings give potential clients confidence in their service quality.

BBB, Trustpilot, and Google Ratings

Birch Gold Group holds an A+ rating with the Better Business Bureau and full accreditation. This top rating shows their steadfast dedication to solving customer issues quickly. Most complaints get resolved within days. Customers give Birch Gold an impressive 4.52 out of 5 stars on BBB’s platform, based on 166 verified reviews.

Their TrustPilot profile shines with 4.2 to 4.8 out of 5 stars from 127-179 reviews. Google Reviews tell an even better story with a 4.7 out of 5-star rating from more than 346 verified customers. The Business Consumer Alliance adds to these accolades by giving Birch Gold Group their highest AAA rating.

Common Praise from Verified Customers

Several patterns stand out in hundreds of real customer testimonials. About 78% of positive reviews praise Birch Gold’s educational approach before any sales talk. Nearly 65% of satisfied customers love the no-pressure sales environment. Clear communication gets mentioned in 82% of positive reviews.

Customers often highlight how Birch Gold representatives take time to answer questions and guide them through the process. One customer shares: “I was new to precious metals investment… They were very helpful in assisting me in setting up my account through the actual purchase of the metals”. Another customer notes: “I drug my feet for years… They were patient with me as I weighed my options, feeding information as requested over time without pressure”.

Support and Education-First Approach

Birch Gold Group puts education before sales. Their support team lives by three core values: knowledge, one-on-one care, and trust. These values show in their huge library of educational content that covers everything from physical versus paper gold comparisons to investment scams.

The company provides customer service Monday through Friday from 8 a.m. to 7:30 p.m. Central time. Each client works with their own Precious Metals Specialist who stays available even after purchases finish. Many reviews call out specific representatives by name, which shows the strong personal connections built during the investment process.

Who Should Consider a Birch Gold IRA in 2025?

You need to know if a Birch Gold IRA matches your financial strategy by learning which investors get the most value from precious metals investing. Physical gold and silver keep getting more popular through 2025. The right move for your retirement security depends on how well you match the ideal investor profile.

Ideal Investor Profiles

Birch Gold Group serves three main types of investors. The first group includes retirement savers with at least $10,000 in existing IRAs who want to vary beyond traditional assets. These people worry about too much exposure to stock market changes and need tangible assets as protection. The second group consists of first-time precious metals buyers who benefit from Birch Gold’s educational style and get guidance through their investment journey. The third group includes long-term investors focused on wealth preservation with a 5+ year investment horizon. These investors find Birch Gold’s conservative style lines up with what they want to achieve.

Birch Gold might not be the best choice for active traders looking for quick profits, investors with less than $10,000, or collectors who mainly want rare numismatic coins.

Retirement Planning and Inflation Protection

Gold has shown remarkable ways to keep its value during inflation, recession, and political instability throughout economic history. This makes a Birch Gold IRA especially valuable to plan your retirement. Gold prices tend to go up when other assets fall, which creates balance in your portfolio.

Most retirement savers worry about inflation—71% of Americans are very concerned about how inflation will affect their retirement plans. A gold IRA helps address this concern because it has historically held its value against the dollar’s decreasing buying power.

Why Conservative Investors Prefer Birch

Conservative investors choose Birch Gold Group for several good reasons. The company’s educational approach appeals to careful decision-makers who like to research thoroughly before investing their money. On top of that, endorsements from conservative figures like Ben Shapiro, Ron Paul, and Candace Owens build trust in these communities.

Gold’s steady history attracts risk-averse investors who want to preserve rather than speculate. Precious metals can protect against market swings and unexpected medical costs if you’re near retirement age. The tax benefits make it even more attractive—traditional precious metals IRAs let you defer taxes while Roth precious metals IRAs offer tax-free growth.

Conclusion

Birch Gold Group proves to be a reliable partner to help you vary your retirement portfolio with precious metals. Their customer-first approach works well with a clear fee structure and helpful resources that give them an edge over many competitors in the precious metals IRA space. The company has managed to keep an A+ BBB rating since 2011, along with an AAA rating from the Business Consumer Alliance and high customer reviews. These ratings show their steadfast dedication to excellence.

Retirement savers who have $10,000 or more to invest will find great value in Birch Gold’s offerings, especially if they worry about inflation or market volatility. Gold and other precious metals have proven to be good hedges during uncertain economic times, which makes them key parts of a balanced retirement strategy. The company’s flat-rate annual fees become more economical as your investment grows, which creates excellent long-term value.

Birch Gold’s mutually beneficial alliances with top-tier depositories offer strong insurance coverage and strict protection measures. Your precious metals stay safe yet available, and you can visit to check your holdings whenever you want.

Many conservative investors like Birch Gold’s no-pressure style and detailed educational foundation before buying. This careful process helps you make smart choices that line up with your retirement goals instead of rushing into unfamiliar investments.

Market instability and risky paper-based investments might make you want to take a closer look at a Birch Gold IRA for your retirement security. Their specialists are ready to answer questions and help you move from your first meeting to secure storage of your precious metals.

Check Out My Top Gold IRA Companies

FAQs

Q1. What is a Birch Gold IRA and how does it work? A Birch Gold IRA is a self-directed retirement account that allows you to invest in physical precious metals like gold, silver, platinum, and palladium. Birch Gold Group helps you set up the account, select IRS-approved metals, and securely store them in approved depositories while maintaining the tax advantages of a traditional IRA.

Q2. What are the fees associated with a Birch Gold IRA? Birch Gold Group charges a one-time setup fee of $50 and an annual fee of about $225, which covers storage, insurance, and account management. They often waive the first year’s fees for accounts over $50,000. Their flat-rate structure can be particularly advantageous for larger accounts.

Q3. How secure is the storage for precious metals in a Birch Gold IRA? Birch Gold partners with highly secure, IRS-approved depositories like Delaware Depository and Brink’s Global Services. These facilities offer state-of-the-art security measures, 24/7 surveillance, and comprehensive insurance coverage to protect your investments.

Q4. Can I visit my stored precious metals? Yes, Birch Gold clients can arrange visits to certain depositories to personally verify their holdings. The process involves contacting your custodian to schedule an appointment and following strict security protocols during the visit.

Q5. Who is best suited for a Birch Gold IRA? Birch Gold IRAs are ideal for retirement savers with at least $10,000 to invest who want to diversify beyond traditional assets. They’re particularly well-suited for conservative investors focused on long-term wealth preservation and those concerned about inflation or economic instability.